Challenges in terms and conditions policy

Concentration in trade

Due to the ongoing consolidation of trade in almost all sectors of the economy, the market power of the remaining retailers is continuously growing. They know how to use this more and more effectively and are building up targeted pressure on their suppliers.

In addition to excessive discount demands, declining loyalty to manufacturer brands is also causing unease. Private labels are taking an increasingly large share of sales and pushing suppliers further to the margins.

Multi channel conflicts

Manufacturers of consumer products as well as most B2B manufacturers, are faced with a complex multi channel landscape. Hardly any supplier can do without sales via the online channel. Even without selling online, their products will appear there anyway via a wide variety of (gray) channels.

Even if the competition authorities assume that online providers have to contend with cost structures similar to those of traditional sales channels, in practice it is quite noticeable that many retailers operate online with very low margins, thus also jeopardizing the price structure in the other channels.

Internationalization

Internationally active groups and retailers are driving many manufacturers ahead of them in their international terms and conditions policy. Groups like Amazon have such sophisticated cross-border logistics that they can exploit price differences in European purchasing for themselves at any time. Large retailers in the independent aftermarket (auto parts trade) demand uniform net prices throughout Europe in their broad-based tenders. Large end customers do not accept non-transparent price distortions between national companies. Manufacturers who do not manage their pricing centrally can no longer meet the requirements of the modern multi channel landscape.

European Framework

An important aspect of conditions policy is international coordination. A centrally managed approach that creates a binding standard for the discount and condition systems in the countries on the basis of rough guardrails has proved successful.

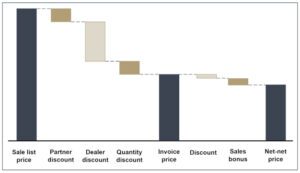

Harmonization of the pricing logic can be significantly advanced by means of a standardized condition scheme, at least throughout Europe. The countries share a common calculation scheme, which is also stored as such in the ERP. Depending on local requirements, elements of the waterfall can be omitted or provided, but no elements may be introduced. This enables central monitoring and control, including performance comparisons between countries.

Performance orientation

Particularly in the case of distribution via retailers, discounts should be linked to specific services provided by the retail partner. In the simplest case, this is the sale of the manufacturer’s products. Against this background, it is not surprising that larger trading partners with higher sales often receive better conditions. However, this is not a matter of course. In this way, partnership-based cooperation can be given a comparably high weight.

In the absence of concrete regulations as to which requirements a retailer must fulfill in order to receive a discount, it is common to find discount levels that do not relate in any way to the retailer’s performance. In the long term, this leads to difficulties when important trading partners, annoyed by the comparatively poor conditions, demand extensive improvements.

It is therefore crucial to have a set of rules that is transparent and binding, at least internally, to prevent undesirable excesses. It is essential to gain a common understanding of performance measurement in retail.

In many industries, especially in B2B sales, the sheer size of the retailer now plays more of a secondary role. Here, it is rather the quality of the cooperation, the qualification of the employees, the cooperation in marketing or the compliance with process standards that play a leading role in the measurement of discounts and bonuses.

In direct business, many aspects of performance orientation play a rather subordinate role. In particular, marketing-related aspects are omitted. But here, too, clear guidelines are needed, for example an orientation to annual sales or peer pricing approaches that ensure consistency in the market price structure.

Multi channel

The various sales channels often have very different strategic roles in a manufacturer’s sales. For example, sales via e-commerce retailers such as Amazon can primarily act as a showcase for the company’s own products on the web. However, e-commerce can also become a central volume channel if this is strategically desired. It is important that a detailed channel strategy exists for all channels, which fully answers the question of role and function.

If the strategic guideline is in place, the condition system can be designed on a channel-specific basis. In concrete terms, this means that the price waterfalls and the services to be provided in the respective channel for discount allocation can differ, in some cases considerably. It is important to ensure that individual channels are not discriminated against. For example, it is conceivable to incentivize stockkeeping in traditional specialist stores and 24-hour delivery capability in online retailing.

Project examples for the management of condition systems

In the past, Roll & Pastuch has already gained extensive experience in the field of conditions policy:

- Introduction of performance-oriented condition system

- Harmonization of condition systems within Europe

- Multi channel strategy and guardrails for conditions policy

- Multi channel condition system

- Peer pricing logics for direct sales incl. CRM integration

Manage condition system actively

We will be happy to answer your questions and provide you with further information.

Prof. Dr. Oliver Roll

Prof. Dr. Oliver Roll is Managing Partner at Prof. Roll & Pastuch – Management Consultants. He is one of the leading pricing experts in the DACH region and has led pricing, sales and strategy projects for numerous international companies. Furthermore Prof. Roll is a key note speaker on the topic of price management and has published numerous articles on various aspects of the pricing process. Prof. Roll holds the chair of “Price Management” at the Osnabrück University of Applied Sciences.

Kai Pastuch

Kai Pastuch is Managing Director of Prof. Roll & Pastuch. Before joining as Managing Partner, he was Director at a leading international strategy and marketing consultancy. As a graduate in business informatics, he also manages our software company nueprice, which specializes in the pricing of spare parts with the product of the same name. Mr. Pastuch has extensive project management experience from numerous projects for large international companies and German medium-sized businesses in the areas of price management, marketing, sales and strategy. In addition to numerous publications in renowned journals and the publication of the reference books Praxishandbuch Preismanagement and Big Deal Management, he is a sought-after moderator and speaker on all aspects of sales and pricing. As a practice-oriented manager, he likes to get personally involved in our projects and contributes his broad experience in workshops and steerings.